Things about Pvm Accounting

Table of ContentsThe Ultimate Guide To Pvm AccountingLittle Known Facts About Pvm Accounting.Not known Details About Pvm Accounting Getting My Pvm Accounting To WorkGet This Report about Pvm AccountingThe Ultimate Guide To Pvm Accounting

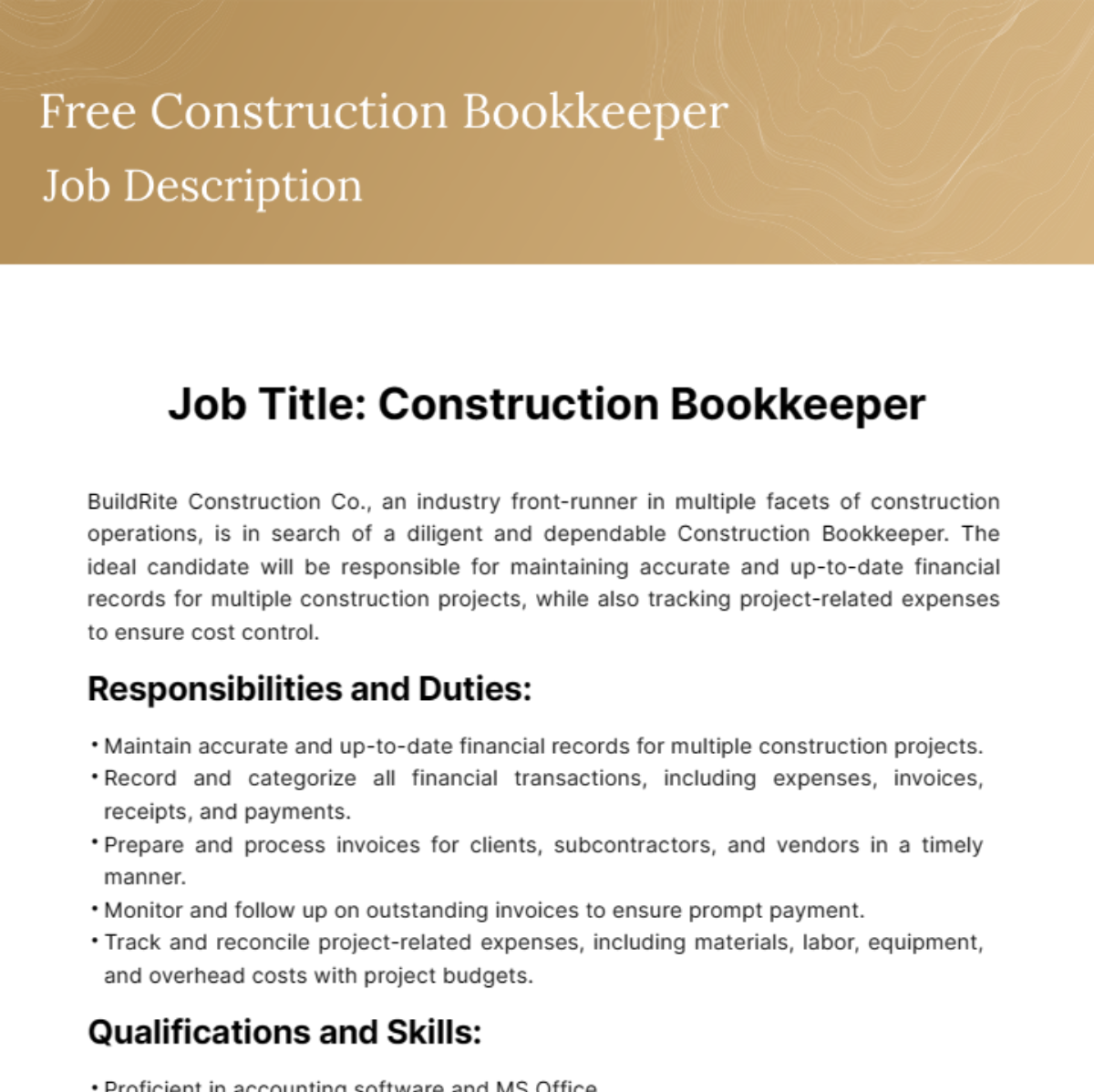

Look after and deal with the production and approval of all project-related payments to customers to promote good communication and stay clear of problems. construction accounting. Make sure that proper records and paperwork are sent to and are upgraded with the IRS. Guarantee that the bookkeeping process abides by the regulation. Apply called for building and construction accountancy criteria and treatments to the recording and reporting of building task.Understand and preserve typical expense codes in the accounting system. Interact with numerous funding companies (i.e. Title Business, Escrow Firm) pertaining to the pay application process and needs needed for payment. Manage lien waiver dispensation and collection - https://on.soundcloud.com/9d9WZsCyJwqD36ob6. Monitor and settle bank problems including charge abnormalities and inspect distinctions. Aid with executing and keeping interior economic controls and procedures.

The above declarations are meant to explain the general nature and level of work being performed by people designated to this classification. They are not to be understood as an extensive listing of duties, duties, and abilities required. Workers might be needed to execute obligations beyond their normal obligations every so often, as needed.

7 Easy Facts About Pvm Accounting Shown

You will assist sustain the Accel team to make certain delivery of successful on time, on budget, jobs. Accel is looking for a Building and construction Accountant for the Chicago Workplace. The Construction Accountant executes a selection of accounting, insurance conformity, and task management. Works both independently and within details divisions to keep financial records and ensure that all documents are maintained existing.

Principal duties consist of, however are not limited to, dealing with all accounting features of the firm in a timely and exact manner and supplying records and timetables to the business's CPA Firm in the prep work of all economic statements. Makes certain that all accounting treatments and features are taken care of properly. In charge of all monetary records, pay-roll, banking and daily operation of the accounting feature.

Works with Job Supervisors to prepare and post all regular monthly billings. Generates month-to-month Task Price to Date reports and functioning with PMs to integrate with Job Managers' budgets for each job.

The Definitive Guide for Pvm Accounting

Efficiency in Sage 300 Construction and Property (previously Sage Timberline Office) and Procore construction management software program a plus. https://j182rvzpbx6.typeform.com/to/qpx4zyP8. Have to also be proficient in various other computer software application systems for the prep work of records, spreadsheets and various other bookkeeping analysis that might be called for by management. construction bookkeeping. Need to have strong organizational abilities and capacity to prioritize

They are the economic custodians who ensure that construction projects stay on spending plan, abide by tax laws, and keep monetary openness. Building and construction accountants are not just number crunchers; they are calculated companions in the construction procedure. Their key duty is to manage the financial aspects of construction projects, guaranteeing that resources are designated effectively and monetary dangers are lessened.

The 7-Minute Rule for Pvm Accounting

They function carefully with task supervisors to develop and keep track of budget plans, track expenditures, and projection economic needs. By maintaining a tight grip on project funds, accounting professionals assist protect against overspending and financial problems. Budgeting is a foundation of successful construction jobs, and construction accounting professionals are important in this regard. They produce comprehensive spending plans that include all project expenditures, from materials and labor to permits and insurance.

Building accounting professionals are well-versed in these policies and make certain that the job conforms with all tax obligation requirements. To stand out in the function of a building and construction accounting professional, individuals require a strong academic structure in accounting and financing.

Furthermore, accreditations such as Certified Public Accounting Professional (CERTIFIED PUBLIC ACCOUNTANT) or Licensed Building And Construction Industry Financial Professional (CCIFP) are very related to in the industry. Building and construction jobs typically involve limited due dates, changing regulations, and unanticipated expenditures.

The Main Principles Of Pvm Accounting

Ans: Building accounting professionals create and keep an eye on budget plans, determining cost-saving opportunities and guaranteeing that the task remains within budget. Ans: Yes, construction accountants handle tax obligation compliance for construction projects.

Intro to Building Bookkeeping By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Construction firms have to make tough choices amongst lots of economic alternatives, like bidding on one job over another, selecting financing for materials or equipment, or establishing a task's earnings margin. On top of that, construction is a notoriously unpredictable sector with a high failing rate, slow-moving time to settlement, and inconsistent cash money flow.

Manufacturing involves repeated processes with conveniently recognizable costs. Production calls for various processes, materials, and devices with differing costs. Each project takes location in a brand-new area with varying site problems and one-of-a-kind challenges.

Get This Report on Pvm Accounting

Durable partnerships with vendors relieve settlements and improve effectiveness. Inconsistent. Regular use different specialized contractors and distributors influences efficiency and capital. No retainage. Repayment gets here completely or with regular repayments for the full agreement amount. Retainage. Some section of settlement might be kept up until project conclusion also when the specialist's job is completed.

Normal manufacturing and short-term agreements result in manageable cash money flow cycles. Irregular. Retainage, slow-moving repayments, and high upfront prices result in long, uneven capital cycles - construction accounting. While typical makers view it now have the benefit of controlled settings and enhanced manufacturing processes, building and construction business have to continuously adjust to every brand-new task. Also somewhat repeatable projects call for adjustments as a result of site problems and various other elements.

Comments on “The Greatest Guide To Pvm Accounting”